An Introduction to Monetary Reform Principles

by Patrick S.J. Carmack, J.D.

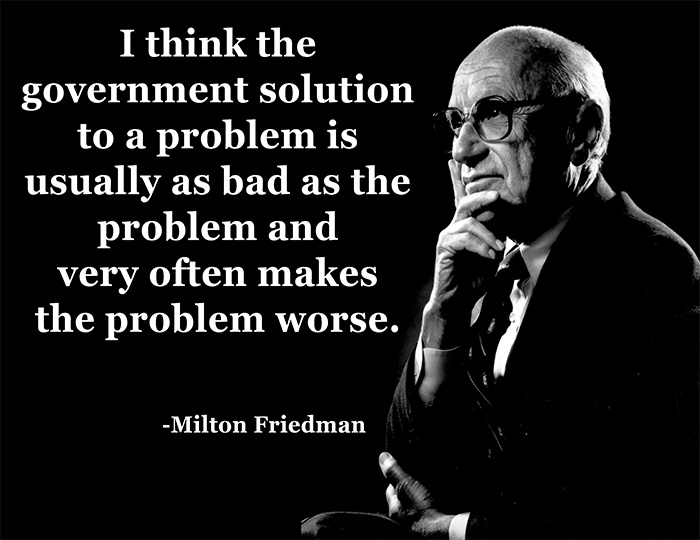

Why draft model reform legislation with little to no chance of enactment under the present circumstances? Nobel Laureate in Economics, Milton Friedman, offers two reasons:

Why draft model reform legislation with little to no chance of enactment under the present circumstances? Nobel Laureate in Economics, Milton Friedman, offers two reasons:

Milton Friedman

…it is worth discussing radical changes, not in the expectation that they will be adopted promptly but for two other reasons. One is to construct an ideal goal, so that incremental changes can be judged by whether they move the institutional structure toward or away from that ideal.

Similarly, Pope John Paul II mentions another yardstick for measuring economic reform proposals:

[by] determining their conformity with or divergence from the lines of the Gospel teaching…

Friedman continues:

The other reason is very different. It is so that if a crisis requiring or facilitating radical change does arise, alternatives will be available that have been carefully developed and fully explored.

Further, modern history is replete with instances in which the Hegelian dialectic has been applied to the political and economic orders to manipulate or soften-up governments to change in ways contrary to the public good. This method usually involves the artificial (i.e. coldly calculated) initiation of conflict of some kind after careful conditioning of the elements of the society who could either obstruct or implement the planned change; followed by a crisis (e.g. an economic or political anomaly such as the stock market crash of 1929 or the oil crises of 1974 and 1979); which is then “interpreted” by controlled mass media to direct the responses to the crisis into pre-planned avenues and away from correct responses such as careful analysis of the causes and criminal indictment of the perpetrators (Manipulation on the personal/psychological order follows a similar pattern of stress, emotion, counseling). Orwell noted this in 1984:

“In governing the populace, unrest cannot be averted. Therefore, it must be channeled and cultivated.”

The following quotation of David Rockefeller, then Chairman of Chase Manhattan bank, speaking at the June, 1991 Bilderberger meeting in Baden Baden, Germany (a meeting attended by then-Governor Bill Clinton) is illustrative of the media control mentioned above:

“We are grateful to the Washington Post, the New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promises of discretion for almost forty years. He went on to explain: It would have been impossible for us to develop our plan for the world if we had been subjected to the lights of publicity during those years. But, the world is more sophisticated and prepared to march towards a world government. The supernational sovereignty of an intellectual elite and world bankers is surely preferable to the national autodetermination practiced in past centuries.”

Similarly, Zbigniew Brzezinski wrote in 1972 that the

“nation state as a fundamental unit of man’s organized life has ceased to be the principal creative force: International banks and multinational corporations are acting and planning in terms that are far in advance of the political concepts of the nation-state.” [Brzezinski, Between Two Ages: The Technetronic Era (Penguin Books , 1971)

Two more interesting pre-9/11 Statements:

“We are on the verge of a global transformation. All we need is the right major crisis and the nation will accept the New World Order.” — David Rockefeller, Chairman of Chase Manhattan Bank (now J.P. Morgan Chase bank)

“The process of transformation.. is likely to be a long one, absent some catastrophic and catalyzing event – like a new Pearl Harbor.” — PNAC (Neo-con Project for a New American Century document)

In light of such scheming, it surely makes sense to attempt to anticipate the dangers involved and to prepare means of escaping them.

“If man lets himself rush ahead without foreseeing in good time the emergence of new social problems, they will become too grave for a peaceful solution to be hoped for.” -Pope Paul VI

Also, such a discussion can encourage the development of authentic reform movements based on the conclusions reached, which would otherwise have no focus or rallying point. Finally, though the mass media would blind us to the sufferings of the 3rd, and now 4th, world by ignoring it and redirecting our interests to sports and fantasy and our compassion to seals and snail darters, nevertheless we will always have the poor with us on this planet, those who suffer the ravages of extreme poverty while we dwell in relative plenty. The number of unemployed people has grown rapidly around the world and was estimated by the International Labor Organization to be over one billion by 1994. In fact, the present debt-based monetary system inevitably results in vast accumulations of wealth in fewer and fewer hands, which necessitates extreme poverty for vast numbers of mankind. In 1997, 441 billionaires owned as much of the world’s wealth as the poorer one-half (50%) of mankind (2.4 billion people). Consistent with one’s state-of-life, we must come to the aid of the increasing multitudes of our impoverished fellow men.

Also, such a discussion can encourage the development of authentic reform movements based on the conclusions reached, which would otherwise have no focus or rallying point. Finally, though the mass media would blind us to the sufferings of the 3rd, and now 4th, world by ignoring it and redirecting our interests to sports and fantasy and our compassion to seals and snail darters, nevertheless we will always have the poor with us on this planet, those who suffer the ravages of extreme poverty while we dwell in relative plenty. The number of unemployed people has grown rapidly around the world and was estimated by the International Labor Organization to be over one billion by 1994. In fact, the present debt-based monetary system inevitably results in vast accumulations of wealth in fewer and fewer hands, which necessitates extreme poverty for vast numbers of mankind. In 1997, 441 billionaires owned as much of the world’s wealth as the poorer one-half (50%) of mankind (2.4 billion people). Consistent with one’s state-of-life, we must come to the aid of the increasing multitudes of our impoverished fellow men.

Let us all set to work, for at this time a grave duty is imposed upon the consciences of all; a duty for all, employers and employees, citizens and farmers, moralists, pastors and their flocks, to help resolutely in the solution of the economic problem that distresses us. Universal suffering puts it in the front rank and bestows upon it a character of sacredness.

These words of French Cardinal Verdier during the Great Monetary Contraction (a.k.a. the Great Depression) are fully apropos to the situation in over four-fifths of the world today, where extreme poverty is ubiquitous and deepening very rapidly. There children are born into a Great Depression which only worsens as they grow up in it.

[Consider] the reality of an innumerable multitude of people – children, adults and the elderly, in other words real and unique persons, who are suffering under the intolerable burden of poverty. There are many millions who are deprived of hope due to the fact that, in many parts of the world, their situation has worsened. Before these tragedies of total indigence and need, in which so many of our brothers and sisters are living, it is the Lord Jesus himself who comes to question us… (Cf. Mt.25:31-46) – Pope John Paul II

Even in the U.S. and Canada the middle class is rapidly being squeezed down into poverty as the poor increase in numbers daily, despite the employment of both spouses now, often holding second and even third jobs, being forced to warehouse their children in institutions.

The philosophers’ ideal of secure, modest wealth widely diffused to all classes is being supplanted by the two extremes, both harmful to mans’ spiritual development, of extreme wealth or extreme poverty. As Mahatma Gandhi noted: Materialism and morality have an inverse relationship – when one increases the other decreases.

We are very rapidly becoming a world composed exclusively of the very few, very rich, and the very many, very poor. The middle remaining cannot hold. Modern technology and mass media has vastly increased the ability of the super-rich to sustain this process to historically unprecedented orders of magnitude. However, some of the effects of this growing disparity in wealth even have the super-rich concerned enough to propose novel “solutions” such as National Security Council Study Memorandum 200 which defines a program aimed at reducing the populations of 13 nations targeted for their raw materials needed to maintain the ruling elite’s lifestyle, including Brazil, India, Columbia, Mexico, Ethiopia and Egypt:

“How much more efficient expenditures for population control might be than [expenditures for] raising production through direct investments in additional irrigation and power plants and factories … (NSSM 200, April, 1974).

Reducing targeted populations to a bare subsistence level by withholding investments, in effect forces less expensive population control on them while reducing to a minimum the labor costs of producing raw materials. Interestingly, since the passage of NAFTA, despite the transfer of hundreds of thousands of U.S. jobs to Mexico, Mexican labor wages have fallen by nearly 50%.

There has also been afoot for some time the “debt-for-nature” scheme proposed at the 4th World Wilderness Conference held in Denver, Colorado in 1987 of forcing nations to transfer national parks and undeveloped areas (up to 30% of the world’s wilderness – 12 billion acres) to a World Wilderness Trust or similar U.N. agencies (and thereby effectively losing sovereignty over part of their national territory) which would function as a collection agent for the IMF, the World Bank and private banks and would operate as follows:

1. Creditor banks transfer 3rd world debt to the World Conservation Bank (a new bank with a “soft” name) thereby relieving the debtor nations of their debt to the original banks;

2. at full book value (even though these loans now have market values as low as 6-25 cents on the dollar and cost the banks nothing to create due to fractional reserve banking – the legally required reserve ratio on such loans being typically 0%);

3. in return for such debt relief, the debtor nations would transfer to the World Wilderness Trust natural resource assets of equivalent value (World Heritage sites such as the Amazon basin or the gold-laden hills around Yellowstone will likely be included at some point); the World Wilderness Trust will eventually allow development by the World Conservation Bank in order to pay the private banks full value for the transferred debts.

Obviously, this scheme, which is already being implemented in Bolivia, Costa Rica and Ecuador, simply interposes a new bank to act in the name of the international community (or the U.N.) as collection agent for the private banks and their jointly run banks (e.g. the IMF and the World Bank), thereby obscuring the stark reality of de facto foreclosure proceedings by private banks against whole national territories. This transforms a politically unpalatable worldwide land grab by private banks into a “conservation transfer” to a body that appears to be a neutral conservation agency of some kind. One of the remarkable features of such institutions is their immunity to popular influence and their hostility to democracy and human need. Widespread economic exploitation of these transferred territories by the private banks will be authorized by the new bank owners, absent the many inconveniences of national sovereignty, regulation and authentic environmental control.

Similar schemes propose every imaginable means, referred to as “substitutes for war”, to exploit or eliminate the poor through coercive forms of demographic control including poverty, famine, forced abortions and sterilization, euthanasia and eugenics, the introduction of new diseases, environmental pollution, etc., and, of course, war itself. A goal of 300-500 million people worldwide (less than 10% of the current world population) is a common theme. Selected, smaller numbers are far easier to manipulate and control, besides, having reduced those on the bottom to unemployment, total desperation and utter destitution, they have no more material utility and being in unresigned and irreligious poverty are too susceptible to authentic “reactionary” alternatives or disturbance. Obviously, such “solutions” are morally repugnant and sound reform alternatives must be presented, which do not destabilize the entire financial system with the attendant risks of a generalized crisis.

What Christianity forbids is to seek solutions … by the ways of hatred, by the murdering of defenseless people, by the methods of terrorism … – Pope John Paul II

The granting of loan extensions, rescheduling, rate reductions or partial remission of debts, though helpful, are at best temporary stop-gap measures merely delaying the day of reckoning. Of course, a debt jubilee (total remission of debts) would entirely solve the problem for the present, but is more than unlikely as few creditors take a broad, selfless or charitable enough view to support such a solution.Rather, too many creditor banks foist policies on their nations, which assume the shape of a ruthless war on the poorer nations, and on the poor in their nations, financing projects over-priced through the fraudulent complicity of corrupted politicians creating odious debts. For example: during the decade 1980-90 Latin American countries paid $418 billion in interest on original loans of $80 billion.

By the end of 1990, 3rd world debt had passed $1.3 trillion over $200 for every living person on earth. This debt had increased by 30% in three years. Debtor nations had total arrears of $26 billion in interest. The Financial Review (October 4, 1990) pointed out that much of the debt was owed to private banks, and that:

…the swelling of arrears has drawn concern from the IMF, where some officials complain that banks are successfullypressing the IMF to become their debt-collection agency…

Nations endowed with power are creating new forms of relationships of inequality and oppression, perverting the use of modern technology and global organizations for this purpose, rather than seeking just revision of loan terms or fundamental reform.

Since most modern money is created by banks as bank loans with an equivalent debt, all nations trade from a position of indebtedness. As a result, nations attempt to export more than they import, deliberately seeking an imbalance of trade, trying to gain a surplus of foreign revenues to reduce their indebtedness. This has caused international trade and foreign relations, to descend from trade for mutual benefit, to thinly disguised economic warfare.

Ever mounting debt has pressured agriculture to become dominated by the production, processing and distribution of every-cheaper food with declining nutritional content, to the increasingly severe detriment of peoples’ health and contrary to clear consumer preference. Large businesses with wasteful mass-production techniques and using large scale transport as a competitive marketing strategy are given an advantage in the intensely competitive financial conditions created by debt-finance. This has culminated in the current ascendancy of huge, bank dominated multinational corporations.

The developed nations have come to rely on private debt to provide their money. This typically involves massive and mounting housing debt via mortgages. Such mortgage debt prevents the majority of people from outright ownership of a home.

Many potentially prosperous 3rd world nations have had their development distorted by the global debt-based financial system. These nations have been entrapped into endemic debt of a wholly false and illegitimate nature, obligated to multinational banks such as the IMF and World Bank whose guiding principles and policies have been designed to support the export drives of the wealthy, developed nations, themselves forced by debt to maximize export revenues.

The terrible poverty this forces on debtor nations limits the development of their peoples, and their intellectual and cultural development is narrowed to the limited exigencies of their daily struggle for survival.

Absent authentic monetary reform, debtor nations unable to pay their debts will ultimately be left with five (5) options:

1. To increase exports in order to increase foreign exchange revenues. Where this is possible, it transforms the citizens into de facto workers for foreign banks which siphon the national production out of the country, further impoverishing the people. Increased commodity production saturates markets and reduces prices, partially or wholly defeating the purpose. In any case this is rarely possible, as exports have usually been maximized already.

2. This necessitates submitting to the IMF-imposed rape of their national resources and the starvation of their people while surrendering their national sovereignty by degrees. This is the option recently taken by the S.E. Asian nations (South Korea, Indonesia, Thailand, Philippines). This is, of course, a closed loop back to debt. Of the $123 billion IMF S.E. Asian bailout, Chase Manhattan bank is in line to receive $32 billion; J.P. Morgan for $23 billion; Bank of America for $16 billion. This $71 billion will never reach S.E. Asia, as it is transferred from the U.S. Treasury, to the IMF, to the Wall Street banks. The IMF bailout saves their bad loans to these nations.

Courtesy of the U.S. government, some such foreign debt is being transferred (“monetized”) to U.S. taxpayers for payment via increased taxes and inflation. Interestingly, Congressional leaders were told by the Clinton Administration that unless they agreed to fund the IMF bailout of banks which make loans to South Korea, there was danger of invasion of South Korea by North Korea war blackmail.

3. Unilaterally to repudiate their foreign debts. This action incurs the danger of being followed by trade strangulation (necessitating barter agreements in foreign trade, as was successfully conducted by the Axis powers and later by Rhodesia), and military invasion (e.g. witness the fate of these defaulter nations: Haiti, Somalia, Iraq, the former Yugoslavia [Bosnia et al.] invaded by U.S. and U.N. armed forces acting as unwitting, de facto mercenaries):

Tote dat bar! Lif dat bale!

Try to buck the system, and you land in jail!It is no easy task to break free of debt, nor of the international banking system. National leaders would obviously have to weigh the consequences of debt repudiation to the specific situation of their nations with great care and sagacity.

4. To seek legal repudiation of their foreign debts, based on the doctrine of “odious debts”. This is an established international law principle permitting debt repudiation when a government incurs a debt without the informed consent of its people, and which is not used in the legitimate interest of the State. Ironically, this doctrine was first used by the U.S. to repudiate Cuba’s debts after the U.S. took Cuba from Spain. The jurist who coined the phrase “the doctrine of odious debts”, held that debts incurred to subjugate a people or to colonize them should also be considered odious. This doctrine shifts responsibility to the lenders, neither to corrupt nor to utilize corrupted politicians and governments to initiate loans, and allows collection from the despots who wasted the funds both desirable changes.

Of course, an independent, uncorrupted judiciary is a prerequisite to obtaining legal repudiation with this legal theory, which is extremely unlikely when corrupted politicians appoint politically subservient judges to the World Court who would hear such cases. A national legal repudiation on this ground would be a good start though, and could be at least legally valid, but might be a practical nullity, resulting in the same consequences as a unilateral repudiation without a recognized legal basis (#3., above).

5. To issue sufficient quantities of the national money specifically to retire the international debt. Since most revenues obtained from foreign loans are shortly spent (often wasted), partly domestically and partly in foreign countries, the results are usually inflationary (in both the country of origin usually the U.S., and in the recipient country), partially multiplied by private domestic (and foreign) banks through fractional reserve banking loans. Therefore, while issuing sufficient new money to retire foreign debt would work, it would also result in hyperinflation where the foreign debt is great in relation to the economy, particularly due to the subsequent multiplier effect of any high-powered money in a fractional reserve banking system. This ruinous negative effect has been felt by numerous nations which inflated to retire foreign debt.

Of course, the technical solution to avoiding such hyperinflation lies in the domestic prohibition of fractional reserve banking, coupled with simultaneous, proportionate foreign exchange regulation, which would require the banks to absorb the new money as increased reserves in a transition to full reserve banking. This response amounts to legislated domestic monetary reform, which is, therefore, not an option “absent authentic monetary reform” (like the first four options above [i.e. 1-4]) but, rather, is authentic monetary reform. In short, if nations find the first four options, above, unacceptable, then they will be forced to consider authentic monetary reform, which brings us back to the subject of this article in order to describe this type of reform.

Having set forth the rationale for drafting model monetary reform legislation, where does one begin? A careful study of the fundamentals of our economic system and of the reforms proposed by scholars is a logical starting point.The draft legislation following was influenced by numerous sources including the writings and declarations on this subject of: President Abraham Lincoln; former Congressmen Charles A. Lindberg, Louis T. McFadden, Robert H. Hemphill, Wright Patman, Francis H. Shoemaker, Jerry Voorhis, Henry Gonzales and former Senator Elmer Thomas, all courageous supporters of banking and monetary reform legislation; Thomas A. Edison; Irving Fisher; Henry C. Simons and the old Chicago School of Economics; Nobel Laureate Frederick Soddy, M.A., F.R.S.; Gertrude M. Coogan; G.K. Chesterton and the Distributist school; Rev. Denis Fahey, C.S.Sp.; Major C.H. Douglas and the Social Credit school; W. Cleon Skousen; Popes Leo XIII, Pius XI, John XXIII, Paul VI, and John Paul II; the Pontifical Commission Justice and Peace; Nobel Laureate Prof. Milton Friedman; Murray N. Rothbard;

Arun Gandhi “Mr. Carmack, What you have shown in the scenario is what we are constantly doing at the personal level as well as the public level. It is the policy of exploitation that the rich employ against the poor. This is why grandfather [Mahatma Gandhi] said ‘Materialism and morality have an inverse relationship – when one increases the other decreases.’ If I may, I would like to keep the videos as resource material to teach students about economic violence in the world. With good wishes. Yours sincerely, Arun Gandhi, M.K. Gandhi Institute for Nonviolence”

Arun Gandhi “Mr. Carmack, What you have shown in the scenario is what we are constantly doing at the personal level as well as the public level. It is the policy of exploitation that the rich employ against the poor. This is why grandfather [Mahatma Gandhi] said ‘Materialism and morality have an inverse relationship – when one increases the other decreases.’ If I may, I would like to keep the videos as resource material to teach students about economic violence in the world. With good wishes. Yours sincerely, Arun Gandhi, M.K. Gandhi Institute for Nonviolence” Milton Friedman “Mr. Carmack, As you know, I am entirely sympathetic with the objectives of your Monetary Reform Act…You deserve a great deal of credit for carrying through so thoroughly on your own conception…I am impressed by your persistence and attention to detail in your successive revisions… Best wishes. Milton Friedman,” Nobel Laureate in Economics; Senior Fellow, Hoover Institution on War, Revolution and Peace

Milton Friedman “Mr. Carmack, As you know, I am entirely sympathetic with the objectives of your Monetary Reform Act…You deserve a great deal of credit for carrying through so thoroughly on your own conception…I am impressed by your persistence and attention to detail in your successive revisions… Best wishes. Milton Friedman,” Nobel Laureate in Economics; Senior Fellow, Hoover Institution on War, Revolution and Peace

Malachi Martin “I endorse the video because people should know what is happening.” – Malachi Martin, late Professor at the Pontifical Biblical Institute and a close associate of Pope John XXIII; author of: The Windswept House; Vatican; The Keys of the Blood, and numerous other books

Malachi Martin “I endorse the video because people should know what is happening.” – Malachi Martin, late Professor at the Pontifical Biblical Institute and a close associate of Pope John XXIII; author of: The Windswept House; Vatican; The Keys of the Blood, and numerous other books Russo “I’m a big fan of The Money Masters. It’s undoubtedly the best work on the Federal Reserve. It convinced me that the only solution to our economic troubles is the Monetary Reform Act. Before that, I had no idea how to get out of this mess. Why can’t our politicians get this? In a single year America could once again be on the path to political and economic freedom. I hold your work in the highest regard and drew from it heavily for my own film.” Aaron Russo, Feb. 2007, Hollywood Producer, Director and Writer of America, Freedom to Fascism

Russo “I’m a big fan of The Money Masters. It’s undoubtedly the best work on the Federal Reserve. It convinced me that the only solution to our economic troubles is the Monetary Reform Act. Before that, I had no idea how to get out of this mess. Why can’t our politicians get this? In a single year America could once again be on the path to political and economic freedom. I hold your work in the highest regard and drew from it heavily for my own film.” Aaron Russo, Feb. 2007, Hollywood Producer, Director and Writer of America, Freedom to Fascism G Edward Griffin I appreciate and applaud your efforts to accomplish something specific in the area of monetary reform. . . I do not hesitate to recommend that people view The Money Masters for the excellent overview of fraudulent banking which it presents. . . G. Edward Griffin,” author of THE CREATURE FROM JEKYLL ISLAND; A Second Look at the Federal Reserve

G Edward Griffin I appreciate and applaud your efforts to accomplish something specific in the area of monetary reform. . . I do not hesitate to recommend that people view The Money Masters for the excellent overview of fraudulent banking which it presents. . . G. Edward Griffin,” author of THE CREATURE FROM JEKYLL ISLAND; A Second Look at the Federal Reserve W Cleon Skousen “This is undoubtedly the most comprehensive presentation of the history of our money system and who is responsible for the disastrous consequences that has left us with an unconstitutional money system and multi-trillion dollar debt.” – Dr. W. Cleon Skousen, author of The Naked Capitalist and The Naked Communist

W Cleon Skousen “This is undoubtedly the most comprehensive presentation of the history of our money system and who is responsible for the disastrous consequences that has left us with an unconstitutional money system and multi-trillion dollar debt.” – Dr. W. Cleon Skousen, author of The Naked Capitalist and The Naked Communist